How to Integrate Product Data into Your CRM (and Why It Matters)

Why Product Data Belongs in Your CRM (And How to Get It There Without the Headaches)

Getting visibility into how customers use your product from within your CRM seems simple — but in reality, it’s a massive operational challenge.

In the era of Product-Led Growth (PLG) and Usage-Based Pricing, not having product data in your CRM is a major risk. Without it, you’re flying blind when it comes to lead qualification, onboarding, expansion, and retention.

This guide covers why product usage data in your CRM is essential, the key use cases where it makes a difference, and how to get it there—without the usual friction.

Why Your CRM Needs Product Data

CRMs like Salesforce and HubSpot were built for sales teams, but they’ve evolved into the single source of truth for GTM teams. In SaaS, what users do inside your product is often more predictive of revenue outcomes than any number of whitepaper downloads or webinar sign-ups.

Product usage data helps teams:

Convert free users to paying customers by identifying Product-Qualified Leads (PQLs).

Personalize onboarding based on real-time adoption signals.

Identify upsell and cross-sell opportunities before they become obvious.

Proactively mitigate churn by detecting early warning signs.

Solicit feedback at the right moment to drive better engagement.

Now, let’s break down the five biggest use cases for having product data in your CRM.

5 Critical Use Cases for Product Data in Your CRM

1. Lead Qualification (Goodbye MQLs, Hello PQLs)

Traditional lead scoring models prioritize Marketing-Qualified Leads (MQLs) based on website engagement. But for PLG companies, the real signal of intent comes from product usage.

That’s why Product-Qualified Leads (PQLs) have become the gold standard. PQLs combine:

Demographic data (company size, industry, job role)

Product usage data (feature adoption, frequency of use, milestone completion)

When a user reaches a certain score based on in-product activity, they’re flagged as a PQL—meaning they’re more likely to convert. To operationalize this, you need product usage data living in your CRM alongside customer and account records.

2. Smarter Onboarding Messaging

A generic onboarding sequence (e.g., X emails over Y days) doesn’t work. Some users self-onboard quickly, while others struggle to take the first step.

With product data in your CRM, you can:

Personalize messaging based on adoption stage (e.g., send advanced tips to power users, or nudge inactive users with value-driven reminders).

Trigger in-app and email sequences at the right moment (e.g., when a user completes their first key action, or when they stall at a critical step).

Prioritize high-touch onboarding for accounts showing low adoption before it’s too late.

3. Expansion Revenue (Upsell & Cross-Sell Signals)

Expansion revenue is a key driver of SaaS growth—and product usage data is your best predictor of when an account is primed for expansion.

By tracking product usage in your CRM, you can:

Identify accounts that are approaching usage limits (e.g., maxing out seats, storage, or API calls) and trigger proactive sales outreach.

Spot accounts that have adopted premium features on a trial basis and need a push toward a paid upgrade.

See which accounts have high team-wide adoption, signaling an opportunity for enterprise-wide expansion.

4. Churn Prediction & Mitigation

Relying on survey-based feedback alone won’t help you detect churn risk. Customers might say they’re happy, but their behavior tells the real story.

With product usage data in your CRM, you can:

Spot early warning signs, like decreasing logins, fewer engaged users, or a sudden drop in feature usage.

Trigger alerts for customer success teams to intervene before churn happens.

Track renewal risk indicators, such as users exporting data or failing to complete critical workflows.

5. Customer Feedback at the Right Time

You don’t want to ask for an NPS review from a customer who’s struggling—or miss the perfect moment when a user is seeing real value.

With product data in your CRM, you can:

Solicit reviews and referrals from power users who have reached key activation milestones.

Request feedback from struggling users to uncover friction points before they churn.

Time survey outreach based on engagement levels, making responses more relevant and actionable.

Why Getting Product Data Into Your CRM Is So Hard

CRMs weren’t built with product usage tracking in mind. Most companies end up hacking together a solution with one of these (flawed) approaches:

1. Reverse ETL (The Data Warehouse Route)

Pulls data from your data warehouse and syncs it back to your CRM.

Requires SQL knowledge and ongoing maintenance.

Often too slow for real-time decision-making.

2. Customer Data Platforms (CDPs)

Tracks in-product behavior in real time.

Requires engineering support for setup and maintenance.

Data overload makes it hard to extract meaningful insights.

3. “Frankenstein” No-Code Integrations

Relies on tools like Zapier to stitch together different systems.

Prone to breaking when APIs change.

Often lacks flexibility for scaling.

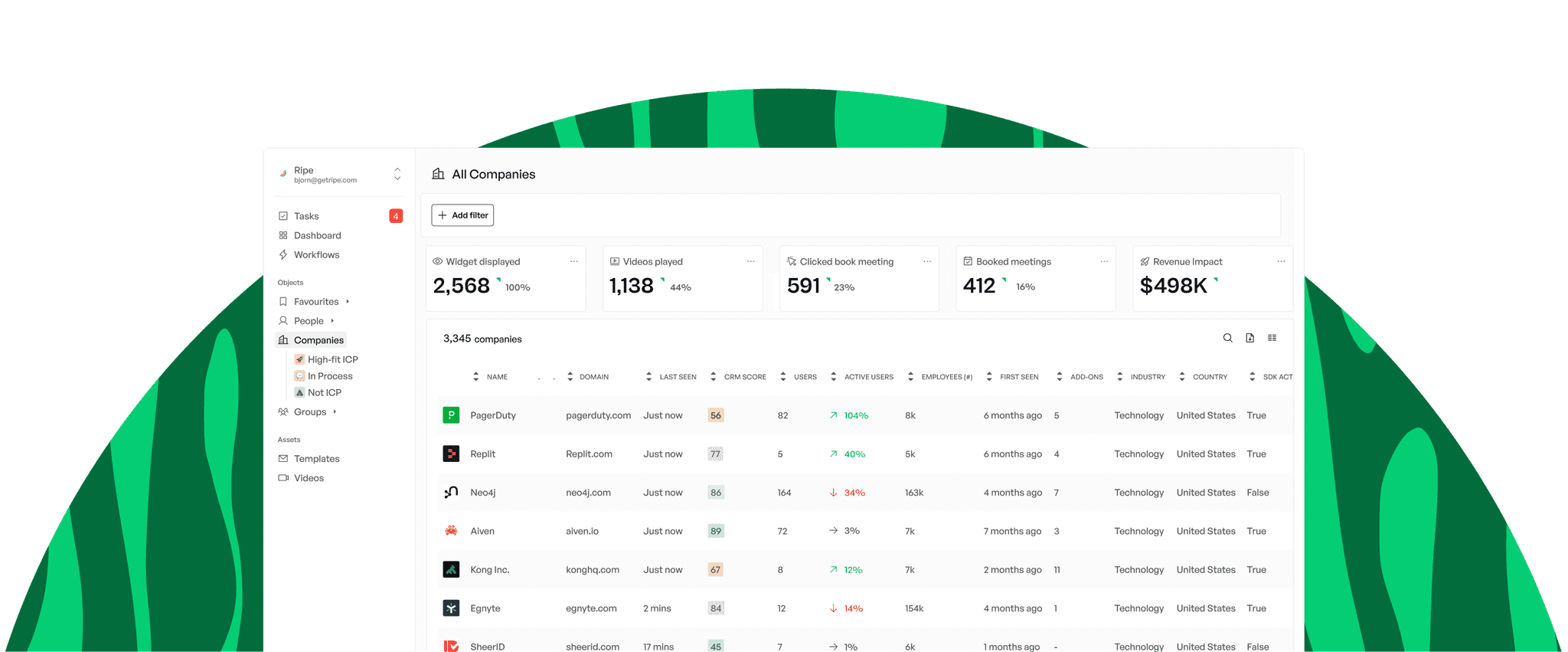

The Better Way: How Ripe Solves This

At Ripe, we believe sales, marketing, and success teams shouldn’t have to depend on engineering to access critical product usage data.

Here’s how we’re different:

No data warehouse or SQL required – Product usage data is instantly accessible within your CRM.

Built for non-technical teams – No ongoing engineering support needed.

Works alongside your existing tools – No extra dashboards, no data silos.

With Ripe, you can finally make product data actionable without the headaches—so your team can focus on revenue, not workarounds.

🚀 Want to see how it works? Check out Ripe today.